Table of Content

Since the gross compensation is determined before deductions, it is always greater than your take-home pay. It covers your bonus, overtime pay, and any other extra benefits your employer might provide. This is a required savings plan that businesses of a particular size are required to offer. It is put in the EPF account and is calculated to be 12% of an employee's base pay. Equal contributions are made to each employee's EPF account by the employer. Tax deductions for employee contributions are allowed up to ₹1.5 lakh per year.

If you are subscribing to an IPO, there is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account. Your take-home pay is determined by a simulation called the Gross Pay & Take Home Salary Calculator. It is the employee’s final take-home pay after all necessary deductions.

Bonus

The employer's contribution is not shown on the pay stub since it is included in the CTC. A take-home pay calculator is a computer program that calculates your net salary after taxes. You must mention the entire bonus as well as the gross salary. It is the house rent allowance provided by the employer to one employee. According to the income tax Act the HRA is exempt from tax. If the employee resides in one of India's metropolises, then 50% of their wage is exempt from HRA taxes.

An annual salary calculator is a handy tool that will instantly calibrate your take-home pay in just a few clicks. You can enter your CTC and the bonus that is a part of it in the formula box on the take-home pay calculator. In addition to annual take-home pay, Vakilsearch's annual salary calculator now displays monthly take-home pay. You can use the salary calculator per month to make it simpler to understand how much money would be available to him or her each month. Salary calculation may be more difficult due to the inclusion of multiple factors.

Human Resource Calculators

You need all the information for using the salary calculator. More than the typical PF contribution of 12 % of one's basic pay, you can contribute up to 100% of your basic salary plus dearness allowance. The VPF Interest rate, which is currently 8.5 %, is the same as the PF Interest rate. After the 5-year lock-in period, withdrawals are entirely tax-free. It is a component of the salary that employers pay to employees for services provided. Depending on the industry norms, the employee's position, etc., This usually is around 50% of the overall income.

As a salaried employee, you will be eligible to claim the LTA exemption under Section 10 of the Income Tax Act. The TDS is not calculated separately in the salary calculator. Your monthly take-home pay is the amount left over after all deductions have been deducted from your gross income.

How Does The Salary Tax Calculator Work?

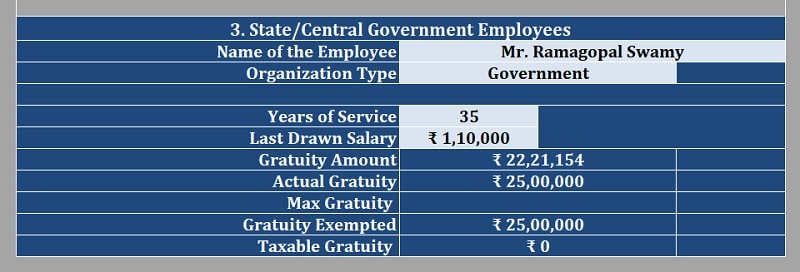

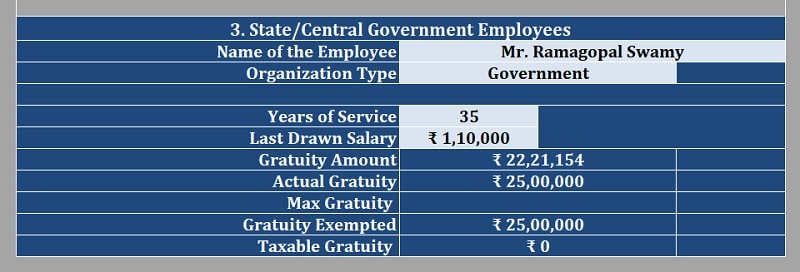

It's a fixed sum that differs between organisations and is granted in addition to your base pay for fulfilling specified criteria. According to the Income Tax Act of 1961, this is a reimbursement provided by your employer for domestic travel while you are on vacation and is not subject to income tax. In exchange for your services, your employer may provide you a gratuity. You must have worked for an organisation for at least five years in order to be eligible to receive a gratuity.

The sum is 40 percent of your base wage in non-metro cities. It’s made to display a clear breakdown of all payroll components, such as take-home pay, gross salary, and income tax. For places like Chennai, Hyderabad, Mumbai, Bengaluru, Pune, New Delhi, Noida, and Gurgaon, it should give you a decent estimate of the net take-home salary and income tax. Nothing much, all you have to do is to know the old or new tax system, CTC, starting wage, monthly rent paid, monthly HRA, health insurance, EPF amount per month.

50% of your basic salary if you are living in metro cities, or 40% of the basic salary if you are living in non-metro cities. Performance reviews - Your annual performance will also define your pay raise. If the reviews provided by your employer are positive, then the pay rise would likely be on the higher end. Insurance - Employers usually provide you with health and life insurance. Every month, a small amount is deducted from your salary for insurance. Special Allowance - Special allowance component in your salary is fully taxable.

The gross salary tends to deduct the professional tax of Rs 2,400 a year . Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day.

An employee can calculate his or her take-home pay using the automated web tool provided by Vakilsearch. It accounts for all applicable tax deductions and salary components. Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources.

Put some money in a savings account, and the interest you receive is tax-free up to 10,000/-. By default, the calculator may use 50% of the CTC as the base wage. Under Section 10 of the Income Tax Act of 1961, an employee is entitled to a gratuity if he or she has worked for the firm for at least five years. Furthermore, your company contributes a matching amount to your EPF account and invests the same amount. Section 80C of the Income Tax Act of 1961 allows you to deduct up to 1.5 lakhs from your contribution.

The entire EPF contributions made by you and your employer must then be deducted. The company always matches the employee’s EPF contribution. Calculating a salary is difficult since it involves various factors. In India, most individuals utilize a salary calculator to save time and effort. Read on to learn more about how the tool may help you with the process. This is a set sum that your company may give you in addition to your base income.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Physics Calculators

Moving ahead, the next component in calculating our take-home salary is the LWF – Labour Welfare Fund. To impart social security to workers, the government introduced the Labour Welfare Fund Act. The act is exercised only in 16 out of the 36 states and union territories in India. LWF does not apply to all categories of employees working in an organization. Cost-to-Company is the overall cost of providing employment and maintaining an employee.

Because pay calculations have so many variables, you’ll need to employ distinct formulae for each one. Your employer also makes a contribution to the EPF account in the same amount. At the time of retirement, you have the option of withdrawing the whole amount accrued.

No comments:

Post a Comment